Some Known Factual Statements About Down Payment Assistance Programs – NeighborWorks

CA Down Payment Assistance

Down Payment Closing Costs Assistance - County of San Diego Things To Know Before You Buy

Chenoa Fund offers the Chenoa Edge and Chenoa Benefit, both of which.

California Down Payment Assistance — Hipster Real Estate

supply.

1ST TIME HOMEBUYER – City View Terrace

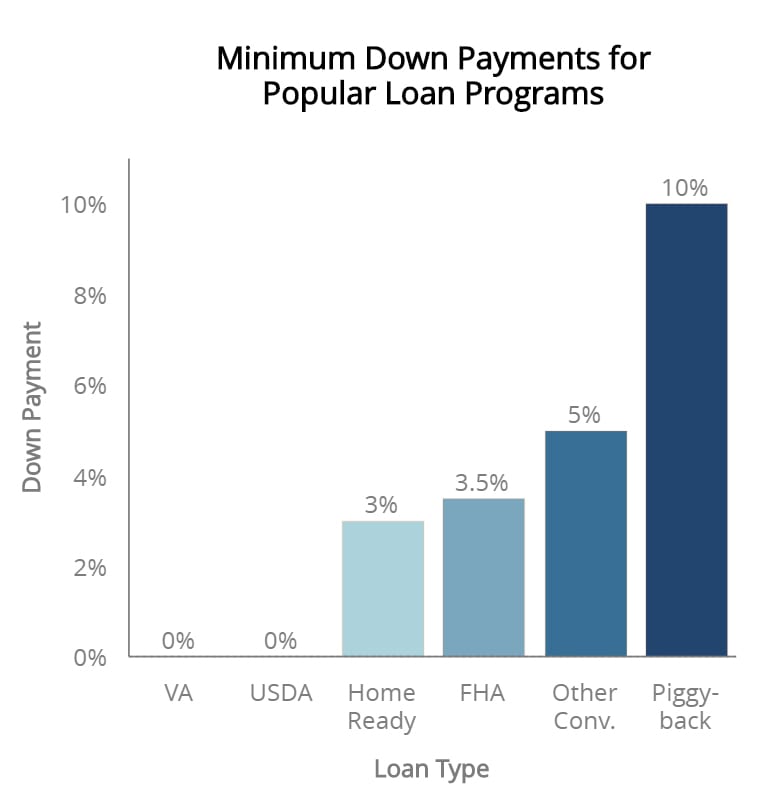

3. 5% of the sales cost to satisfy the minimum down payment when utilizing an FHA loan. Additional Info is in the kind of a 2nd mortgage which may or may not be forgivable, 620 minimum credit rating, and borrowers DO NOT need to be very first time buyers. NHF provides up to 4% grant cash for eligible home buyers that never ever has actually to be paid back. Readily available in all counties throughout California, purchasers only need a 620 credit report and can DTI ratios can increase to 50 %! Borrowers do not have to very first time buyers and can even own other residential or commercial properties. 5% grant that can be used towards the down payment or paying closing costs. Eligible in all 58 counties in California and do not have to be very first time property buyers. DTI ratios up to 56%. Down payment support program using Standard financing for buyers with good credit and earnings. The loan provider offers a 2% grant and purchaser just requires 1% of their own funds. Purchaser funds can be talented from a family member. Fannie Mae closing cost assistance program that offers buyers up to 3% when purchasing a Fannie Mae owned home. Property buyer support grant that can be used towards down payment or closing expenses. CHAP supplies a lowered rates of interest or closing expense credit for homebuyers and homeowners who wish to buy or re-finance a home situated in an eligible county and zip code of California. There are no income limitations. CHF ACCESS uses 3% deposit support in the type of a second lien. Not limited to very first time buyers, offered in all counties, and has versatile certifying credit requirements. In fact, it's possible to qualify with a 580 FICO credit history.( GAIN ACCESS TO program has been DISCONTNUED )The Home mortgage Credit Certificate makes house ownership more budget-friendly for very first time house buyers by lowering a purchasers federal earnings tax liability.